How Important Are Debt to Equity Ratios?

Use debt to equity ratios to evaluate companies like an advanced investor. Here's how to use it and the pros and cons you should know.

What Is the Debt to Equity Ratio?

The debt to equity ratio measures the leverage of a company by comparing the book value of its debts to the value of the shareholders' equity. In other words, the ratio determines how much debt a company needs to operate.

The calculation of this ratio is very simple and can be understood simply by its title. To determine a company’s debt to equity ratio, you simply divide the total debt by the total amount of equity or the total value of assets. Each of these figures is found on the company’s balance sheet.

To understand this concept, let’s take a look at an example.

A Clarifying Example

Two companies, Shoes 4 You and Lace Place, have emerged as potentially enticing competitors in the shoe industry.

You, a potential investor, want to examine how each company has operated thus far and determine which would be the more reliable investment using debt to equity ratios. To compute this metric, you discover that the formula for D/E ratios is as follows: Debt-To-Equity Ratio = Total Liabilities/Total Equity

Now that you know the formula for calculating the ratio you check each company’s balance sheet (financial statements are available for all publicly traded companies). You find that Shoes 4 You has $55,000 in debt and $12,500 in total equity, while Lace Place has $33,000 in debt and $11,250 in total equity. Therefore, Shoes 4 You has higher debt but also has higher value in its company's equity. Lace Place has lower debt but also a lower value of total equity.

After dividing each debt figure by the corresponding equity for that company, you conclude that Shoes 4 You’s debt to equity ratio is 4.4 and Lace Place’s is 2.93.

Contextualizing Debt to Equity Ratios

The debt to equity ratio signifies the amount of financial leverage a company has, or how much debt they are willing to accumulate to operate.

- A company’s total debt can be calculated by finding the sum of business loans, current liabilities, and other debt obligations they may have.

- A company's assets can be calculated by determining its liquidity. Once an investor determines how much cash a company has, it may add that value to any cash equivalents that can be liquidated, and they will determine the company’s total assets.

Back to our example...

Since Shoes 4 You has a higher ratio of debt to equity than Lace Place, you can surmise that Lace Place uses less debt to operate its business. However, you are still not sure if 2.93 is a good ratio, so you do some research.

Now, debt to equity ratios will usually fluctuate according to the market, but generally speaking, a good ratio is lower than 1 and implies a safe investment. The ratio is considered too high if it is above 2. Therefore, even though Lace Place reports a lower debt to equity ratio, it is still relatively high and you decide not to invest.

Benefits and Shortcomings of Debt to Equity Ratios

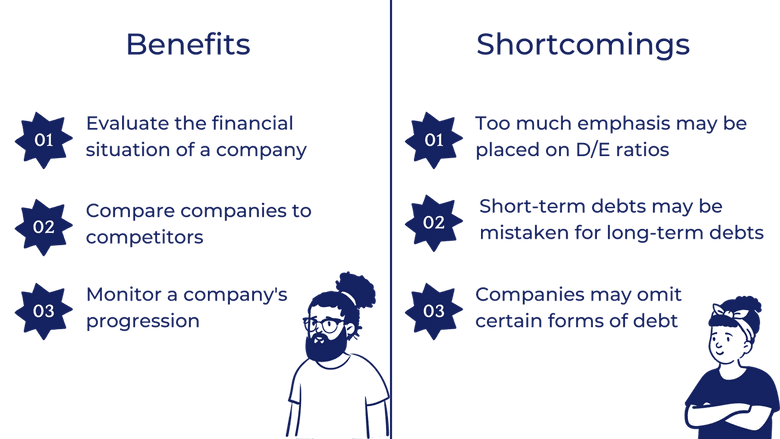

Benefits

- D/E ratios allow investors to evaluate the financial situation of a company.

- Investors can differentiate between companies that owe large sums of debt and compare them to competitors who operate with funds they’ve accumulated from assets.

- D/E ratios can monitor a company's progression when analyzed over a period of time. If company leadership changes, for example, fluctuations in D/E ratios may mean that the new financial guidance makes investment more or less enticing.

Shortcomings

- Investors may place too much emphasis on D/E ratios and run away if they are too high, though the figure may only represent a minor setback that the company will bounce back from. High D/E ratios can represent a risky investment in a stock that uses too much debt to survive, or it could represent the perfect time to invest because the stock may never be available at such a discount.

- Short-term debts may disguise themselves amongst long-term debts and consequently portray an inaccurate representation of a company’s financial situation. The amount of debt a company owes to lenders may not be useful when categorized as low debt or high debt but should be contextualized to explain a company's current situation.

- Companies may choose to omit certain forms of debt, such as accounts payable and debt with no interest rates, to make their total liabilities figure seem more presentable. This may cause an investor to mistakenly trust the organization without knowing about the other expenditures it is still responsible for. To combat this issue, it may be wise to inquire about what each figure accounts for and how the company represents its liabilities on the balance sheet.

Takeaways

- The debt to equity ratio is calculated by dividing a company’s total liabilities by the value of its assets.

- The total of a company’s assets can be found directly on its balance sheet. It is the sum of cash, short-term assets, and long-term assets.

- A company’s liabilities can be calculated by accounting for all its debt obligations such as business loans. Some companies purposefully omit non-interest debt and other liabilities in order to make the figure more enticing - therefore, investors may want to look into exactly how the total liabilities figure was calculated on the balance sheet.

- D/E ratios may need to be contextualized to be used effectively. More specifically, debts can be short-term or long-term, which may have implications for potential investment.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.