The 3 Top Secondary Market Equity Platforms

Everything you need to know about what, why and how to invest in startups

When Google first entered the stock market in 2004, the search engine was worth $27 billion, less than the toothpaste brand Colgate-Palmolive. Now, Google is one of the few U.S. tech companies worth $1 trillion. Those who bought shares back in 2004 have made millions.

This example illustrates the rewarding possibilities that investing in startups can bring. Specifically, investing in a company’s pre-IPO stocks has the potential to lead to massive gains.

So how can you discover the next Google?

First, A Few Key Definitions

What is an IPO?

An initial public offering (IPO) is the first sale of stock by a company. This happens when a private company goes public, entering the stock market.

What is a Pre-IPO?

A pre-initial public offering is a private sale of a company’s shares before their stock is listed on a public exchange. In the past, this was an exclusive opportunity only for accredited investors, private equity firms, hedge funds and a few other groups. However, since the 2012 JOBS Act, the bill has made it far easier to participate in pre-IPO investing. Unaccredited investors can invest in pre-IPO companies with as little as $100.

By offering pre-IPO shares, companies are able to both raise funds and offset the risk that the IPO is not successful, and investors are able to get shares of a company at a discounted IPO price, typically of around 15%. That’s why for successful companies, pre-IPO stocks will oftentimes be the lowest price point its stock will ever be at. However, this discount comes at a cost.

What are the Risks?

1. Capital Loss

Startup companies are not guaranteed to succeed, meaning that any investment is comes with a high risk of a total or partial loss of the sums invested. If a company fails, you will suffer a complete loss of money.

A pro tip: Only invest the amount of money that you can afford to lose.

2. Lack of Liquidity

Liquidity refers to how easily you can turn an asset into cash. Statutory clauses have led to restrictions on pre-IPO stocks, meaning that investors cannot quickly cash out their stocks. Pre-IPO investors are subject to a “lock-up period,” in which they are not allowed to sell any stock for a certain number of days. Money put towards pre-IPO shares should be viewed as a long-term investment.

A pro tip: Do not invest if you require easy, rapid access to your money.

3. Scarcity of Dividends

Dividends are payments made by publicly-listed companies to reward investors for putting money into their businesses. With pre-IPO stocks, dividends are rare because these startups are just starting to gain traction and focusing on expansion. Thus there is a scarcity of dividends – many pre-IPO companies cannot or rarely pay dividends because their shareholders are more concerned with reinvesting those earnings into the company.

4. Dilution

Share dilution is what happens when a company issues new stock, decreasing a shareholders’ ownership in the company. When the number of shares increases, it makes each share less valuable. Any investment, not just pre-IPO investments, could be subject to dilution.

However, investors run into these risks whenever they enter the stock market in general, and taking these risks can lead to major profits. Ultimately, pre-IPO shares are a way for people to invest in startups and – hopefully – reap a portion of the benefits from their success.

So How Do I Invest in Pre-IPO Shares?

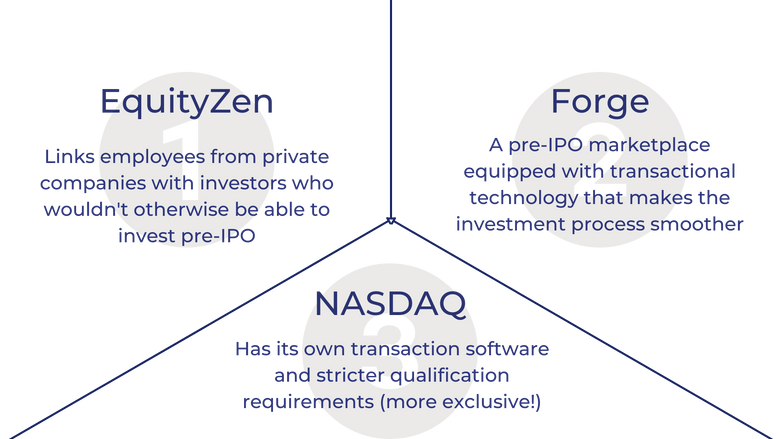

Pre-IPO investing isn’t a simple task; without the right financial knowledge, connections and resources, it isn’t easy to uncover pre-IPO companies, let alone the ones that are predicted to incur strong returns. In order to make it easier, here are 3 online pre-IPO marketplaces for discovering and investing in pre-IPO companies.

These platforms offer various services and have different qualifications that must be met in order for investors to utilize the marketplace.

1. EquityZen

Founded in 2013, EquityZen is a financial services company that acts as a broker, arranging transactions between investors and shareholders of private companies. Prices for a company’s pre-IPO shares are marketed to registered buyers through the online marketplace and email marketing. In order to use the platform, certain qualifications must be met by both investors and shareholders:

- Investors must register to offer a minimum of $150,000 for securities

- Investments must be at least $20,000

- Companies need to have at least $50 million in enterprise value in order to be listed on the marketplace.

Once a buyer is interested, EquityZen contacts the company for approval, and if approved, goes ahead and processes the transaction. For every transaction, EquityZen charges a commission of 3-5% depending on the size of the deal.

Key Highlights

- 15,000+ investments closed

- $725B estimated total market cap of transacted companies

- 250+ companies served

Since their start, EquityZen has transacted over half of the largest 25 private Venture Capital-backed companies including Lyft, Evernote and AppNexus. These transactions provided private shareholders from these companies – employees, early founders, early investors – the opportunity to sell a small portion of their equity to buyers interested in their startup.

2. Forge Global

Forge Global is an online pre-IPO equity marketplace with a ‘Deal Engine,’ or their transactional technology, which makes finalizing transactions easier for both parties. Their marketplace relies on an expansive dataset and global connections to make sure companies and investors get their best matches.

Key Highlights

- 10,000+ client transactions

- 320+ companies served

The transactional software is able to calculate and set prices for shares through non-binding, private offers from shareholders that provide a ball-park price and volume of pre-IPO equity in each company. This process ensures full transparency for both parties on how pricing is set in the marketplace. Registered investors can then use the platform to show interest in a company’s pre-IPO shares, set up a transaction via Forge, and strike a deal. Following every transaction that provides liquidity to sellers, Forge charges a transaction fee of 2-4%.

In addition, Forge acquired another pre-IPO platform, SharesPost, in 2020, making the company one of the largest private securities marketplaces in the world. The merger also means that the platform will provide greater access to private growth companies and integrate SharesPost’s Private Securities Specialist, which helps clients navigate the private market.

3. NASDAQ Private Market

The NASDAQ Private Market is a software-as-a-service company (Saas), equipped with a transaction software that allows companies and investors to tender offers or share buybacks. The NASDAQ private marketplace also utilizes a structured sales program, allowing companies to impose guidelines or restrictions around their pre-IPO equity, approve individual transactions as necessary, and determine how the price of their stocks are set. Since initiating this program in 2013, the company has arranged over 15,350 individual transactions.

Unlike the other marketplaces, NASDAQ has stricter listing requirements for companies and shareholders.

Listing Requirements

- Companies listed on the NASDAQ private market must have raised at least $30 million in funding in the past two years or have a valuation of $50 million

- Companies need to have at least $750,000 in annual net income

- Companies need to have sponsorship by a recognized and experienced financial investor(s) with prior success in venture investments

These stricter qualifications have allowed the company to streamline which businesses are allowed to list their pre-IPO equity in their marketplace. The marketplace itself is one of the leading companies in the industry, and recently set a new record for facilitating 29 private company-sponsored secondary transactions within a six month period.

Starting to Invest, List and Profit

Ultimately, pre-IPO equity provides an economical opportunity for both startups and investors; investors have the potential to make lucrative investments that propel companies to further expand their businesses and technologies.

Those who are interested in either selling or investing can speak with brokers, financial advisors, or register to an online marketplace. While the risks may be hefty, the rewards can be astonishing. Good luck!

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.